Definint el Futur de les Empreses MGA

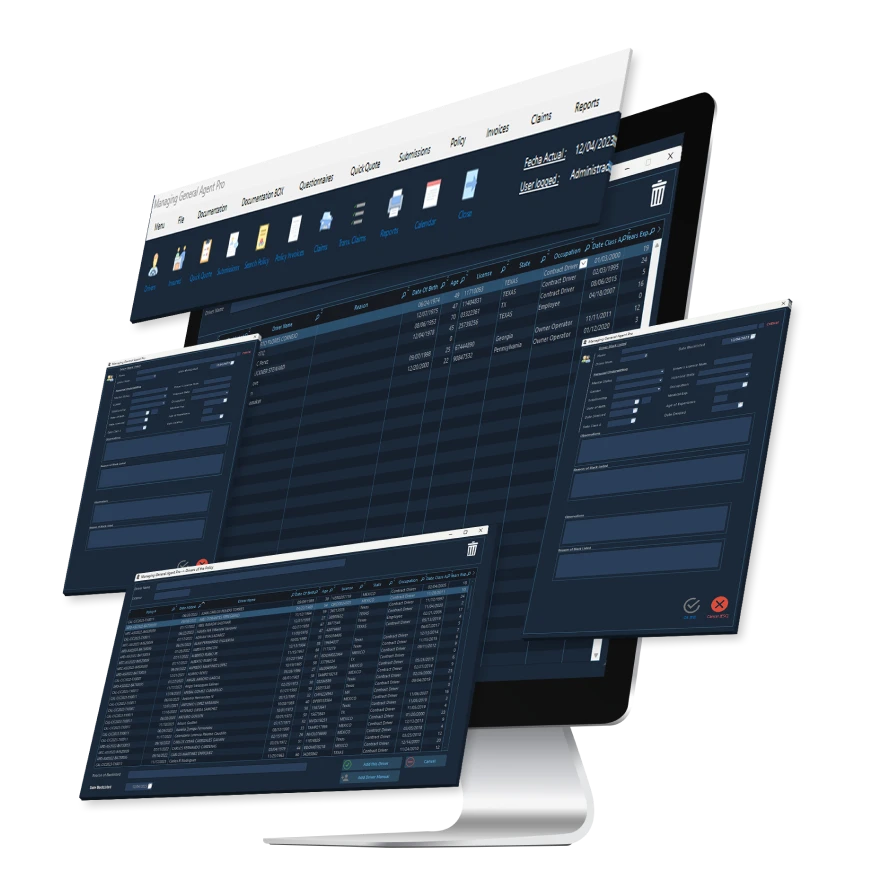

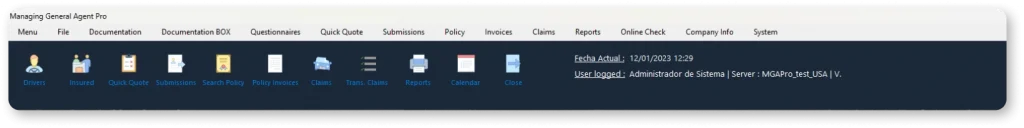

MGApro és un software integral pensat per optimitzar la gestió de la teva empresa.

Gestió d’assegurances sense complicacions

Elimina els punts crítics del sector amb la nostra aplicació de gestió d’assegurances i web feta a mida.

Les asseguradores i els intermediaris gestionen una gran quantitat de dades que sovint queden disperses en bases de dades redundants i sistemes antics, fet que dificulta centralitzar tota la informació valuosa en una única font fiable per prendre decisions informades.

Per mantenir una línia de creixement consistent, les companyies d’assegurances han de fomentar una cultura de treball orientada a les dades, que permeti identificar clients rendibles i gestionar tot el seu cicle de vida, des de l’adquisició fins a la maduresa.

Com a especialistes en solucions de software, hem creat un conjunt de panells de gestió d’assegurances dissenyats a mida per resoldre els principals reptes que afronten asseguradores i MGA’s. Les nostres solucions ofereixen una visió unificada de les teves dades, ajudant-te a obtenir insights valuosos, optimitzar processos i prendre decisions basades en dades.

Com MGApro ajuda les agències d’assegurances

Gestió eficient de pòlisses 🚀

El software de gestió d’MGApro millora significativament l’eficiència en la gestió de pòlisses. Els agents es beneficien de processos simplificats per a l’emissió, modificació i renovació de pòlisses. El software dona accés ràpid a tota la informació, facilita actualitzacions sense interrupcions i garanteix una documentació precisa.

Aquesta eficiència es tradueix en una millor experiència per als clients, reduint el temps i l’esforç necessaris en les tasques relacionades amb les pòlisses. A més, la interfície intuïtiva permet una navegació fàcil, assegurant que els agents puguin gestionar pòlisses amb una formació mínima.

Solucions de cobertura a mida 🛡️

El software d’MGApro ofereix solucions personalitzades per adaptar-se a les necessitats específiques de cada client. Els agents poden ajustar opcions de cobertura segons els requisits particulars, garantint una protecció completa per a negocis de transport.

El software permet treballar amb una àmplia varietat de cobertures i límits, aportant flexibilitat en el disseny de pòlisses. Amb funcions detallades d’entrada i gestió de dades, els agents poden adaptar fàcilment les opcions de cobertura i oferir als clients les millors solucions possibles. Aquest enfocament personalitzat reforça la relació amb els clients i millora la seva satisfacció.

Seguretat i protecció de dades 🔐

El software de gestió d’MGApro prioritza la seguretat i la protecció de la informació sensible dels clients amb mesures de seguretat robustes. Utilitza protocols avançats d’encriptació i solucions d’emmagatzematge segur per protegir contra accessos no autoritzats i filtracions de dades.

Les actualitzacions regulars i el compliment d’estàndards del sector garanteixen que totes les dades dels clients es mantinguin protegides. Aquest compromís amb la seguretat no només protegeix els clients, sinó que també genera confiança en els serveis d’MGApro, aportant tranquil·litat tant a agents com a assegurats

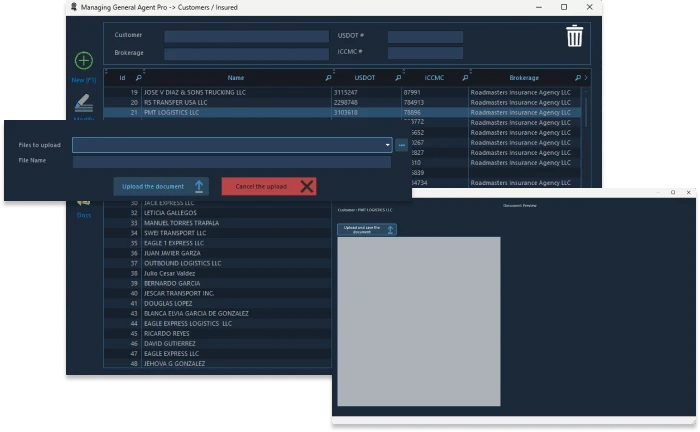

Assegurats

La secció Insured del software MGA ajuda a gestionar de manera eficient els clients d’assegurances de camions. Els agents poden introduir i consultar dades essencials com noms de clients, números USDOT i ICCMC. El sistema permet carregar i previsualitzar documents directament al perfil del client, assegurant que tots els arxius digitals estiguin organitzats i fàcilment accessibles.

Aquesta funcionalitat optimitza la gestió documental, millora l’exactitud de les dades i garanteix que la informació crítica estigui sempre actualitzada i disponible quan calgui.

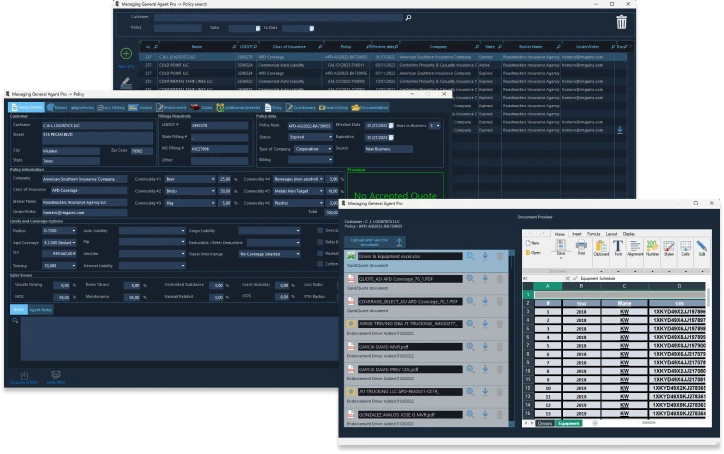

Pòlisses

La secció Policy del software MGA simplifica la gestió de pòlisses d’assegurances per a clients del sector del transport. Els agents poden introduir i consultar informació detallada del client i de la pòlissa, gestionar tipus i límits de cobertura, franquícies, endossos, sinistres i interessos addicionals.

Les funcions clau inclouen una entrada de dades completa, gestió de cobertures adaptada a les necessitats del client i un sistema robust per pujar, organitzar i previsualitzar documents essencials.

A més, els agents poden registrar notes i mantenir un historial de comunicacions dins de la pòlissa, garantint que tota la informació relacionada estigui centralitzada, accessible i gestionada de manera eficient.

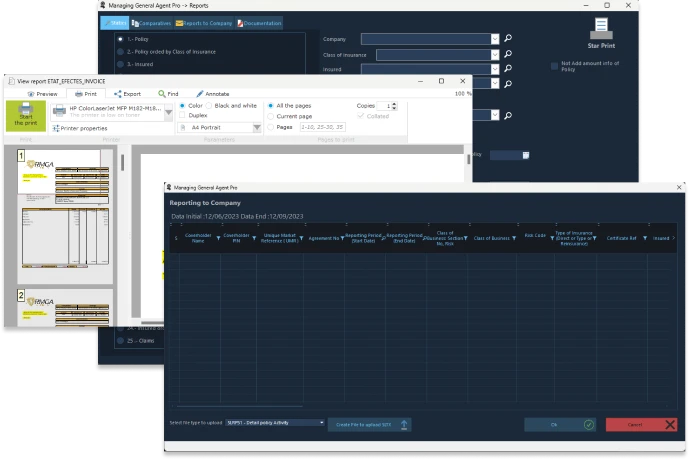

Reports

La secció Reports facilita la generació i gestió d’informes detallats d’assegurances. Els agents poden crear diversos tipus d’informes, com resums de pòlisses, informes per tipologia d’assegurança o llistats de clients assegurats.

Les funcionalitats clau inclouen paràmetres de configuració personalitzats, opcions d’impressió i exportació, i eines per anotar i organitzar dades.

A més, la secció permet generar informes corporatius detallats amb rangs de dates i filtres específics, garantint informes complets i precisos per a totes les activitats asseguradores.

Aquesta funcionalitat millora la capacitat d’analitzar i presentar dades crítiques de manera eficient.

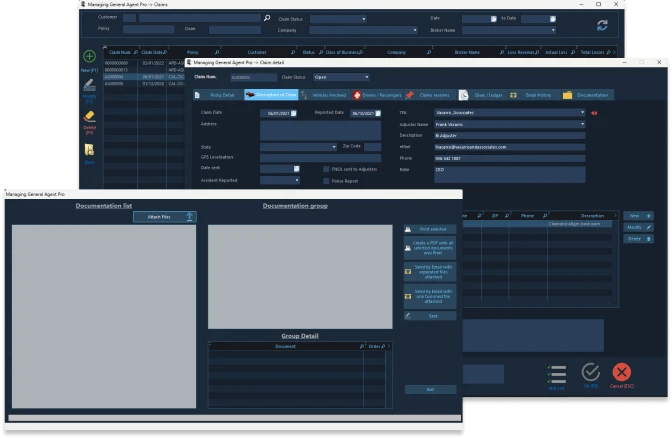

Reclamacions

Dins la secció Reclamacions del software MGA, els usuaris poden gestionar i processar reclamacions d’assegurança de manera eficient. Els agents tenen la capacitat d’introduir i fer seguiment d’informació detallada, incloent números de reclamació, dates, estats i pòlisses associades.

Les funcionalitats principals inclouen registrar descripcions de les reclamacions, gestionar vehicles i conductors implicats i monitorar les reserves de reclamacions.

La secció també permet adjuntar i organitzar tota la documentació, facilitant-ne la consulta i revisió. A més, inclou eines per imprimir documents seleccionats, crear PDFs i enviar fitxers per correu electrònic, assegurant una comunicació fluida i una documentació completa durant tot el procés.

Aquesta funcionalitat millora la precisió, organització i eficiència en la gestió de reclamacions.

Per què l’aplicació web MGA és el company perfecte

Gestió de tasques optimitzada 📅

L’aplicació web d’MGA ofereix als agents una plataforma fluida per gestionar múltiples tasques i fluxos de treball. El calendari integrat permet controlar dates i terminis importants, com ara renovacions de pòlisses, assegurant que no s’escapi res. El menú inclou opcions com QuickQuotes, gestió de pòlisses, gestió de reclamacions, vídeos de seguretat, conciliacions i informes. Aquesta suite d’eines completa permet als agents gestionar el seu dia a dia i la relació amb els clients des d’una única interfície clara i fàcil d’utilitzar.

Gestió de dades completa 📊

L’aplicació web d’MGA destaca per oferir una gestió de dades detallada i perfectament organitzada. Els agents poden moure’s fàcilment entre diferents pestanyes, com Main, Drivers, Vehicles, Loss History, Documentation, Coverages, Presentations i Email History. Cada pestanya està dissenyada per capturar i mostrar la informació rellevant, assegurant que els agents tinguin totes les dades necessàries a l’abast en qualsevol moment. Aquesta estructura no només facilita una recuperació ràpida de la informació, sinó que també garanteix que totes les dades dels clients es mantinguin de forma precisa i eficient.

Disseny centrat en l’usuari 💻

L’aplicació web d’MGA està dissenyada pensant en l’usuari, amb una interfície altament intuïtiva i accessible. Inclou configuracions personalitzables, un blog per a actualitzacions i informació, i opcions d’ajust per adaptar l’aplicació a les necessitats de cada agent. El disseny i la funcionalitat estan optimitzats perquè els agents puguin completar les seves tasques amb el mínim esforç i la màxima eficiència. Aquest enfocament centrat en l’usuari millora la productivitat general i garanteix una experiència fluida i agradable.

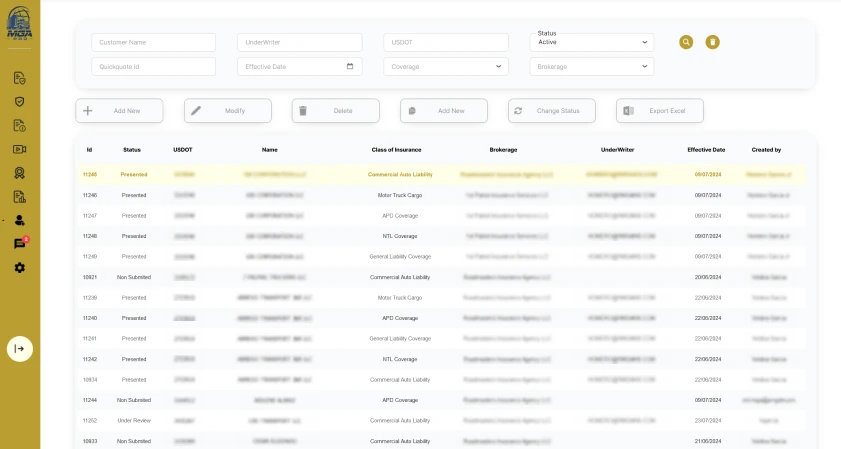

QuickQuote

La secció QuickQuote de l’aplicació web d’MGA permet als agents generar i gestionar pressupostos d’assegurança de manera eficient. Els agents poden cercar i filtrar pressupostos utilitzant criteris com el nom del client, l’underwriter, el número USDOT, l’ID de QuickQuote, la data d’efecte, el tipus de cobertura i la brokerage.

Les funcions principals inclouen crear nous pressupostos, modificar-ne d’existents, eliminar pressupostos seleccionats, canviar-ne l’estat i exportar les dades a Excel. La llista detallada de pressupostos mostra informació essencial com l’ID, l’estat, el número USDOT, el nom del client, la classe d’assegurança, la brokerage, l’underwriter, la data d’efecte i el creador.

Aquesta interfície optimitzada millora la rapidesa i la precisió en la generació de pressupostos, fent que el procés sigui molt més eficient i fàcil d’utilitzar per als agents.

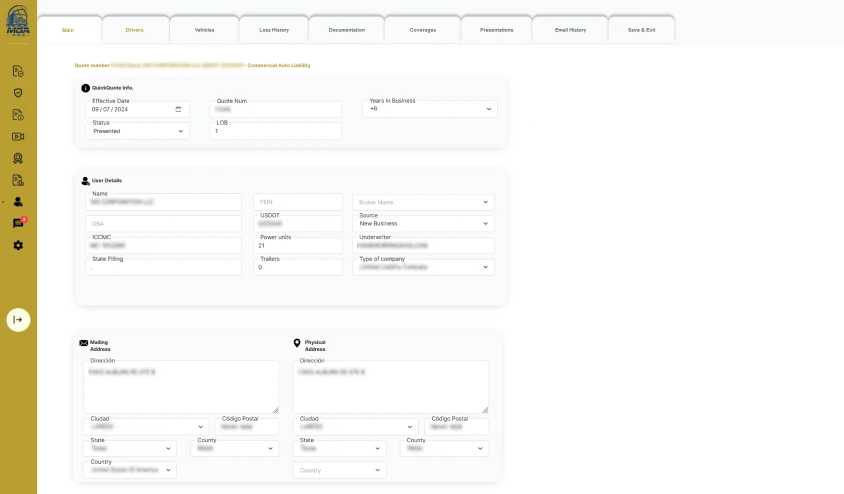

Informació del Client

La secció d’informació del client de l’aplicació web d’MGA proporciona camps detallats per capturar totes les dades essencials sobre el client i les seves necessitats d’assegurança. Els elements principals inclouen informació de QuickQuote, com la data d’efecte, el número de pressupost, els anys d’activitat i l’estat.

La secció de dades del client recull informació completa com el nom, el número USDOT, l’ICCMC, la potència dels vehicles, els remolcs, el nom del broker, l’origen del negoci, l’underwriter i el tipus d’empresa.

A més, aquesta secció permet introduir tant l’adreça postal com l’adreça física, garantint informació de contacte completa i precisa.

Aquest conjunt de funcionalitats permet als agents recopilar totes les dades necessàries per generar pressupostos d’assegurança precisos i personalitzats, facilitant una gestió de pòlisses eficient i efectiva.