Andorra 2026 minimum wage and CPI: real impact on company payrolls

The minimum wage in Andorra in 2026 and the variation of the CPI in Andorra introduce relevant changes for all companies with salaried workers. This is not just an economic adjustment, but a direct impact on payroll management in Andorra , labor costs and financial planning.

Understanding these changes well is key to avoiding errors, internal mismatches and regulatory compliance problems.

New minimum wage in Andorra in 2026

The new amounts are:

Minimum hourly wage Andorra 2026: €8.80

Minimum monthly wage Andorra 2026: €1,525.33 (legal working day)

This increase directly affects:

Workers who earn the minimum wage.

Contracts indexed to the minimum wage.

Salary scales that must maintain internal coherence.

In many cases, an increase in the minimum wage forces other wages to be reviewed to avoid overlaps or imbalances.

CPI Andorra 2026 and salary revisions

The Andorran CPI , with a variation of 2.7% , continues to be a key reference in:

Agreed salary reviews.

Automatic contract updates.

Economic adjustments linked to the cost of living.

For many companies, the CPI is not optional. It is part of contractual clauses and internal wage policy criteria. Failure to apply it correctly can generate labor conflicts or budget deviations.

How the minimum wage and the CPI affect payrolls in Andorra

When the minimum wage and the CPI change, payroll management in Andorra must adapt immediately. It is necessary to review:

Base salaries.

Salary supplements.

Contributions to the CASS.

Total cost per worker.

Cumulative impact on the annual budget.

Making these calculations manually or with systems not adapted to Andorran regulations increases the risk of errors and inconsistencies.

Automate payroll management in Andorra

When changes arrive such as the minimum wage in Andorra 2026 or revisions linked to the CPI , the real challenge for many companies is not information, but how to apply these adjustments to payrolls without errors or loss of time .

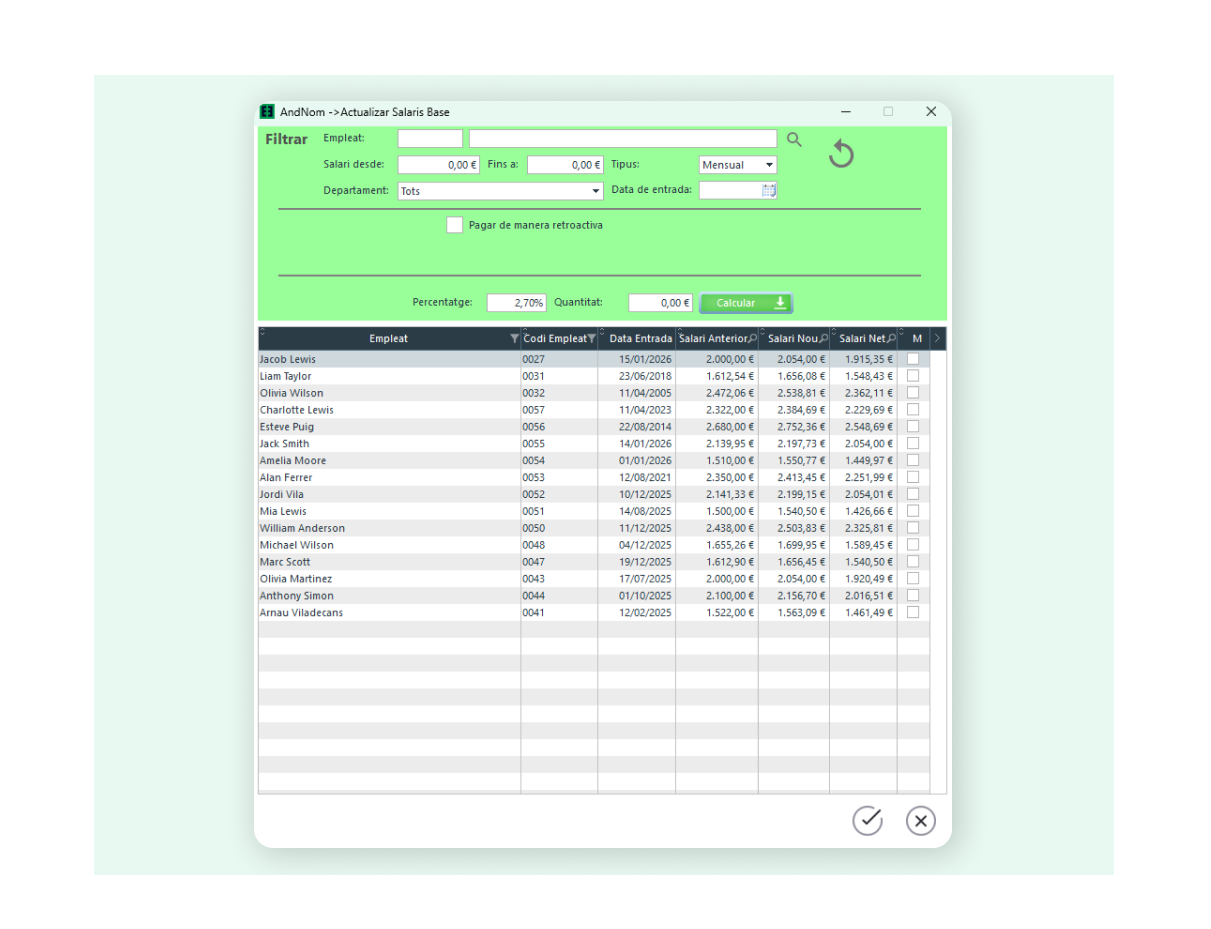

AndNom is designed precisely for this: to execute salary reviews in a fast, controlled and scalable manner within payroll management in Andorra.

With AndNom, companies can:

Apply salary increases massively in just a few clicks.

Define different percentages according to salary range or department .

Simulate the economic impact before applying the changes.

Guarantee consistency and traceability in all payrolls.

The result is much more agile and secure management, especially in contexts of regulatory changes, where each adjustment must be well calculated and documented.

For companies that want real control over their payrolls in Andorra , without slow manual processes or scattered spreadsheets, AndNom becomes a key tool to face salary reviews with peace of mind.

Financial planning and legal compliance in 2026

Changes in the minimum wage and the CPI don’t just affect Human Resources. They also impact:

Company budgets.

Growth scenarios.

Hiring decisions.

Compliance with inspections and audits.

Anticipating these adjustments and working with correct data allows companies to make informed and sustainable decisions, avoiding improvisations.

Official sources on the minimum wage and CPI in Andorra

For more information:

Frequently asked questions

1. What is the latest update to the minimum wage in Andorra?

The latest update to the minimum wage in Andorra is approved through a decree published in the BOPA and sets the new salary base applicable to all affected contracts. For 2026, the increase has been determined taking into account the evolution of the CPI and its impact on company payrolls. It is important to review the effective date in order to apply the changes correctly.

2. Where can I consult the official minimum wage table in Andorra?

The official minimum wage table can be consulted in the Official Gazette of the Principality of Andorra (BOPA), where the corresponding decree is published. It is also advisable to verify the information through official Government sources or through payroll management tools that integrate updated regulations.

3. What is the effective date of the minimum wage update?

The effective date is specified in the decree published in the BOPA. The minimum wage update usually comes into force at the beginning of the calendar year, but it is essential to confirm this to ensure that payroll is calculated correctly from the date of application.

4. How does the minimum wage update in Andorra affect employment contracts?

The minimum wage update requires companies to review the affected employment contracts and adjust payroll if the salary base falls below the new legal amount. This may involve changes in labor costs, social contributions, and budget planning for 2026.

5. Are there companies in Andorra that offer simulators to calculate the updated minimum wage?

Some companies and payroll management software solutions in Andorra offer simulators or tools to calculate the impact of the new minimum wage on payroll. For example, AndNom, the payroll software developed by ProgDev, allows companies to anticipate costs, verify legal compliance, and adapt workforce management efficiently in line with Andorran regulations.

Are you ready to simplify work management with AndNom?

Human Resources management